|

|

|||

|

|||

|

Welcome to the Collective Interest

Center to Preserve Social Security |

|||

|

The Basics on Social Security " Social Security disability benefits " Calculating retirement benefits " Widows and survivors benefit information " The Future of Social Security " |

|||

|

Preservation Information Links: The straight poop on preserving Social Security " Social Security Administration Online " Common Sense on Social Security " Concord Coalition on Social Security Reform " What Would Really Happen Under Social Security Privatization? " Save Social Security " The Social Security Solvency Simulator " " There is No Crisis " AARP Social Seurity Update Blog " |

|||

|

Reform Dis-Information Links: Beware conservatives bearing gifts.... " Social Security Reform Center "The Presiden't Plan to Strengthen Social Security " |

|||

|

Special Reports: Links and downloadable .pdf's of various reports and findings on Social Security preservation AARP Report of Impact of Social Security Reform on Women " Concord Coalition Report on Social Security Reform " AARP Report of Social Security Reform " 12 Bad Ideas About Social Security Reform " 2004 Social Security Trustee Report " 2004 Social Security Trustee Report Update (Fall 2004) " Social Security and Productivity Growth " " Sen. Graham's Social Security Reform Plan (called "Plan B" it is as close to what the administration is expected to formally propose) " " Furman Memo (an addendum to Senator Graham's "Plan B" report) " |

|||

|

Stories/Blog Posts of Interest:

The conversation on Social Security reform and preservation |

|||

| Wednesday, May 11 | |||

|

THE IMPACT OF THE PRESIDENT'S PROPOSAL ON SOCIAL SECURITY SOLVENCY AND THE BUDGET Wednesday, May 11 (Center for Budget and Policy Priorites)The President has now announced two parts of his Social Security plan. In his State of the Union Address on February 2, he proposed private accounts, to be paid for by reductions in traditional Social Security benefits. In an April 28 press conference, the President announced sliding-scale benefit reductions modeled on a plan proposed by investment executive Robert Pozen. Unfortunately, the White House has not released the traditional analysis by the Social Security actuaries of the effect of its plan on Social Security solvency. It is standard practice for policymakers and outside analysts who present Social Security plans to provide the actuaries analysis when, or shortly after, they release their plans. In the absence of an analysis by the Social Security actuaries, this analysis provides some of the standard actuarial and fiscal estimates of the Presidents proposal.[1] The analysis is based on the actuaries analysis of the Pozen proposal, which has been released, analyses by the actuaries of other private-account plans that contain features similar to those of the Presidents plan, analysis by the actuaries of the Presidents private accounts through 2015, and the data in the 2005 Social Security trustees report. More |

|||

|

SOCIAL SECURITY LIFTS1 MILLION CHILDREN ABOVE THE POVERTY LINE Wednesday, May 11 (Center for Budget and Policy Priorities)A little-known aspect of the Social Security program is its powerful role in providing income security for children. Census Bureau data show that 5.3 million children lived in families that received income from Social Security in 2002. Many of these children qualified themselves for Social Security payments because they were the survivor or dependent of a deceased, disabled, or retired worker who qualified for Social Security. Other children do not receive payments themselves but live in families where someone receives Social Security. An analysis of Census data shows that: " Nationwide, Social Security benefits lifted one million children under 18 above the poverty line in 2002. " Apart from the earned income tax credit, no other government program lifts more children above the poverty line. " Social Security reduced the number of children whose families had disposable incomes below the poverty line in 2002 from 10.3 million (when Social Security is not counted) to 9.3 million (when Social Security is counted), a reduction of one-tenth. " In half of the states, Social Security lifts more than10,000 children our of poverty. These state data cover the period 2000-2002. (Disposable income means income after taxes and counting any government income assistance, food stamps, school lunch, housing benefits, or energy assistance.) More |

|||

|

FIXING SOCIAL SECURITY CHANGES DO NEED TO BE MADE, BUT THE CHOICES ARENT HARD NOR THE MEASURES PAINFUL By Robert M. Ball, former Commissioner of Social Security Wednesday, May 11 (New Century Foundation)President George W. Bush has said that the administrations first task in the Social Security reform debate is to demonstrate to the American people that Social Security has a big financial problema crisis requiring action now. In trying to make this case, those speaking for the administration have done everything they can think of to make the long-range shortfall in Social Security seem as big as possible. They have greatly exaggerated the problem in three different ways. The first is to present the drop in the workers-to-beneficiary ratio as very large and unplanned for. They point out that in 1950 there were 16 workers paying into the system for each beneficiary taking out, and that the ratio has gone way down so that now the ratio is only 3.3 workers to each beneficiary and in the long run it will be only 2 to 1 or even 1.9 to 1. They ignore the fact that in 1950 only about 15 percent of the elderly were eligible for benefits and that it was expected by all who were acquainted with the program that the ratio would, of course, change dramatically as a greater proportion of the elderly became beneficiaries. Instead, the impression is left that the program was sound only when 16 paid in for every one taking out. Thus, of course, when the ratio changed to 3.3 to 1, the program became unsustainable. What in fact happened is that when just about all the elderly first became eligible for Social Security benefits, about 1975, the ratio was 3.3 contributors to each beneficiary and the ratio has stayed that way for the past 30 years. As the baby boom reaches retirement age, as the administration says, the ratio is expected to drop for the long run to 2.0 or 1.9 workers to each retiree. But that is the size of the problema drop from 3.3 to 2 workers pre retiree. The much used 16 to 1 figure is simply a reflection of the immaturity of the system back in 1950 when very few of the elderly had worked under the program long enough to be eligible for benefits. More |

|||

| Monday, May 9 | |||

|

Ex-TSP chief says private Social Security accounts face steep challenge Monday, May 9 (GovExec.com)The first chief administrator of the federal Thrift Savings Plan said Thursday that President Bush's plan for establishing personal accounts as part of a Social Security overhaul faces "overwhelming" practical challenges. "The administration's plan for universal [individual accounts] is not feasible and it should not survive the process of responsible congressional hearings," Francis Cavanaugh, who served as executive director of the Federal Retirement Thrift Investment Board from 1986 to 1994, told the House Financial Services Monetary Policy Subcommittee. Cavanaugh said there are "considerable dissimilarities" between the Bush administration's plan and the Thrift Savings Plan, which is often cited as a model for the proposed Social Security investment accounts. While only the federal government administers the TSP, Cavanaugh said the Social Security individual account proposal would create administrative burdens for many types of companies, especially small businesses. More |

|||

|

The Final Insult By PAUL KRUGMAN Monday, May 9 (New York Times)Hell hath no fury like a scammer foiled. The card shark caught marking the deck, the auto dealer caught resetting a used car's odometer, is rarely contrite. On the contrary, they're usually angry, and they lash out at their intended marks, crying hypocrisy. And so it is with those who would privatize Social Security. They didn't get away with scare tactics, or claims to offer something for nothing. Now they're accusing their opponents of coddling the rich and not caring about the poor. Well, why not? It's no more outrageous than other arguments they've tried. Remember the claim that Social Security is bad for black people? Before I take on this final insult to our intelligence, let me deal with a fundamental misconception: the idea that President Bush's plan would somehow protect future Social Security benefits. If the plan really would do that, it would be worth discussing. It's possible - not certain, but possible - that 40 or 50 years from now Social Security won't have enough money coming in to pay full benefits. (If the economy grows as fast over the next 50 years as it did over the past half-century, Social Security will do just fine.) So there's a case for making small sacrifices now to avoid bigger sacrifices later. More |

|||

| Wednesday, May 4 | |||

|

The Automatic 401(k): A Simple Way to Strengthen Retirement Savings Retirement Security Project, March 2005 Wednesday, May 4 (The Brookings Institution)Over the past quarter century, private pension plans in the United States have trended toward a do-it-yourself approach, in which covered workers bear more investment risk and make more of their own decisions about their retirement savings. Some workers have thrived under this more individualized approach, amassing sizable balances in 401(k)s and similar plans, which will assure them a comfortable and relatively secure retirement income. For others, however, the 401(k) revolution has fallen short of its potential. Work, family, and other more immediate demands often distract workers from the need to save and invest for the future. Those who do take the time to consider their choices find the decisions quite complex: individual financial planning is seldom a simple task. For many workers, the result is poor decision making at each stage of the retirement savings process, putting both the level and the security of their retirement income at risk. Even worse, in the face of such difficult choices, many people simply procrastinate and thereby avoid dealing with the issues altogether, which dramatically raises the likelihood that they will not save enough for retirement. A disarmingly simple conceptwhat we call the "automatic 401(k)"has the potential to cut through this Gordian knot and improve retirement security for millions of workers through a set of common sense reforms. In a nutshell, the automatic 401(k) consists of changing the default option at each phase of the 401(k) savings cycle to make sound saving and investment decisions the norm, even when the worker never gets around to making a choice in the first place. More To download the report, click here |

|||

| Tuesday, May 3 | |||

|

Social Security sacrifices expected Tuesday, May 3 (USA Today)A solid majority of Americans predict that their benefits will have to be cut or their taxes raised to ensure the long-term future of Social Security, a sign that most people are prepared to endure some pain to preserve the nation's retirement system. (Related: Poll results) A USA TODAY/CNN/Gallup Poll taken Friday through Sunday finds both parties viewed skeptically on the issue, though. Sixty-two percent worry that Republicans will "go too far" in changing Social Security; 61% worry that Democrats "will not go far enough." President Bush, who has put Social Security at the top of his second-term agenda, gets his worst rating so far on the issue: 35% approval, 58% disapproval. The idea he endorsed last week of "progressive indexing" maintaining future benefits for low-income workers but reducing initial benefits for the middle-class and affluent was opposed by 54%-38%. "Ideally, people would like for nothing to change, but that is not an option, and they are coming around to that realization," says Republican pollster Whit Ayres. "But they have not yet coalesced around any alternative plan." Democratic pollster Geoffrey Garin sees bad news for Bush. "The more time he spends on this, the worse it gets for him," Garin says. More |

|||

| Friday, April 29 | |||

|

AN ANALYSIS OF USING "PROGRESSIVE PRICE INDEXING" TO SET SOCIAL SECURITY BENEFITS Friday, April 29 (Center for Budget and Policy Priorites)Robert Pozen, a former vice chairman of Fidelity Investments and member of President Bushs Social Security Commission, has proposed a change in the Social Security benefit structure that he refers to as progressive indexing. Senators Lindsey Graham and Robert Bennett, among others, have indicated they are considering including this proposal in Social Security plans they are developing. In addition, President Bush praised the proposal at a March 16 press conference, and White House press secretary Scott McClellan subsequently called the proposal very useful and constructive. Under the proposal, low-earners would continue to receive the Social Security benefits promised under current law, which are based on a formula that uses wage indexing, while high-earners would have their benefits calculated under a formula that uses price indexing instead, with the result that their benefits would be reduced. (The benefit reductions would be phased in and would grow over time.) For average workers, benefits would be calculated by using a mix of wage indexing and price indexing; their benefits would be reduced but by a smaller percentage than benefits for higher earners. This paper analyzes progressive price indexing. It contains five significant findings: " Progressive price indexing would transform Social Security over time from a retirement program to more of a welfare system that provides a modest retirement benefit largely unrelated to income. Because progressive price indexing produces very large reductions in benefits over time for high earners, substantial benefit reductions for average earners, and no reductions for low earners, it eventually eliminates most differences in benefit levels. Ultimately, most beneficiaries would get the same monthly benefit, despite having paid in very different amounts in payroll taxes. Under current law, high earners (those whose earnings are 60 percent above the earnings of the average earner) receive Social Security benefits that are 33 percent higher than the benefits that average earners get. Under progressive price indexing, this difference would shrink to only 7 percent for workers retiring in 2075, and the difference would be eliminated entirely by 2100. This raises the question of whether broad political support for Social Security can be sustained if workers pay very different amounts of payroll taxes but most workers receive the same level of benefits. More |

|||

|

Bush Recasts Message on Social Security He favors a means-based approach to benefits, though he does not offer specifics. It appears to be an effort to gain backing from Senate moderates. Friday, April 29 (LA Times)President Bush, seeking support from Democrats and moderate Republicans for an overhaul of Social Security, said Thursday that he favored changing the pension system so that benefits for low-income workers would grow faster than those for wealthy retirees. Bush, speaking at a nationally televised news conference, said such a change "would solve most of the funding challenges facing Social Security." He cited a proposal by a Democratic policy expert to reduce the rate of growth in benefits for wealthy workers but did not explicitly endorse the plan, saying it was up to Congress to work out the details. With the president's ambitions for restructuring Social Security apparently stalled despite weeks of barnstorming to mobilize public support, his endorsement of what he called means-based benefits appeared designed to inject momentum into the debate. Aides said it was also a response to Senate moderates from both parties who had called on Bush to lay out specific steps to shore up the finances of the system. More |

|||

|

Bush's hard sell on Social Security hard to figure Friday, April 29 (Newsday)One of the most interesting aspects of my job is the ongoing interaction with you, the readers. I'm constantly aware - and reminded - that there are many readers who know a great deal about a subject I'm writing about because they've either spent their life in a particular business or have made a study of a particular subject. That was certainly the case this past week when I received a letter from David A. Levene of Melville outlining his thoughts about President George W. Bush's crusade to privatize the Social Security system. Taking the time to read Levene's letter on the "fuzzy math" of the Bush proposal gave me insight into why the administration is having so much trouble convincing Congress and the people that the president's concept makes sense. The Senate finance committee opened hearings this week utterly divided on what to do, not even certain all Republicans would support the president. Levene, it turns out, was a senior vice president and chief actuary for Metropolitan Life Insurance Co. He spent 41 years with that company, including time in the retirement savings division, before retiring in 2003 at age 62. That is to say he knows a little bit about this topic, but he takes pains to note that his point is his personal opinion. And his point is that if the Bush administration is willing to borrow billions of dollars to finance the transition costs to a system of personal accounts, it would be more efficient to take those billions and put them directly into the current Social Security system. Why? Because the return on investment would be better than what you could receive in private accounts. More |

|||

|

Bush Cites Plan That Would Cut Social Security Benefits

Friday, April 29 (New York Times)President Bush called Thursday night for cutting Social Security benefits for future retirees to put the system on sound financial footing, and he proposed doing so in a way that would demand the most sacrifice from higher-income people while insulating low-income workers. Advertisement Saying the retirement program is headed for "bankruptcy," a term his opponents say is an exaggeration, Mr. Bush edged tentatively - but for the first time explicitly - into the most politically explosive aspect of the debate over how to assure Social Security's long-term health: the benefit cuts or tax increases needed to balance the system's books as the baby boom generation ages and life expectancy increases. "Social Security's provided a safety net that has provided dignity and peace of mind for millions of Americans in their retirement," Mr. Bush said at the beginning of a news conference at the White House. "Yet there's a hole in the safety net because Congresses have made promises it cannot keep for a younger generation." (Full Transcript | Excerpts) He also forcefully defended his nominee for United Nations ambassador, John R. Bolton, and rejected assertions by some members of his own party that Democrats who oppose his judicial nominees are not people of faith. He pledged to do everything possible to make gasoline more affordable, and declined to put a timetable on the withdrawal of troops from Iraq. More |

|||

| Wednesday, February 9 | |||

|

Senate Democrats Shine a Bright Light on Bush "Privatization Tax" Wednesday, February 9 (Sen. Harry Reid's Website)Ranking Member on the Senate Finance Committee Max Baucus joined Democratic Senators Dick Durbin, Charles Schumer and Jon Corzine Wednesday in calling on President Bush and the Republicans to come clean about the effects of the "privatization tax" contained in the President's Social Security privatization plan. With the new "privatization tax," the Republicans are going to give with one hand and take away with the other. Their plan will allow individuals to take money from the Social Security Trust Fund and put it into private accounts. But to recoup this money and lost interest for the Trust Fund, the Republicans will issue the new privatization tax, which will eliminate benefits by up to 70 percent or more. More |

|||

|

Retirement Turns Into a Rest Stop as Benefits Dwindle Working Without a Net Wednesday, February 9 (New York Times)The rising cost of health insurance and changes in retirement benefits have recently prompted more older people to keep their jobs longer or go back to work. For John A. Lemoine, retirement has been hard work. Forced to take an early pension package at AT&T three years ago, Mr. Lemoine, 54, a former building manager who once made more than $70,000 a year handling the operations of several AT&T sites, soon found that retirement was something he just could not afford. To supplement the greatly reduced pension he received upon his retirement, he first took an $11-an-hour job as a maintenance worker at the Sam's Club up the road from his home here. He retrained as an X-ray technician, and began earning $17.50 an hour as a part-time radiology technician for several clinics. Still unable to make ends meet, he also took a full-time job as a security guard for an hourly wage of $10.50. "I put in for other jobs, too," Mr. Lemoine said. "You'd be surprised who won't hire you because of your age." More |

|||

| Tuesday, February 8 | |||

|

Private SS accounts, deconstructed Tuesday, February 8 (Scripps-Howard News Service)President Bush skipped the specifics of his plan for private Social Security accounts in the State of the Union and follow-up speeches, but details have begun to emerge. Here is what's known: Q: How much could I put into my account? A: Workers younger than 55 could divert 4 percent of pay up to $1,000 the first year with the annual maximum rising $100 plus inflation until everyone can contribute 4 percent of pay, whatever they make. That's about a third of the 12.4 percent Social Security payroll tax, which employers and employees split. Q: Who qualifies? A: Anyone born after 1949. People 55 or older stay in traditional Social Security. Workers born before 1966 could enroll in 2009, before 1979 in 2010 and everyone else in 2011. Those who opt for private accounts cannot switch back if the market tanks, and they get smaller Social Security retirement checks that will be cut 3 percent plus inflation for every year they are in the work force. That's the same sum that 4 percent of pay would earn had it stayed invested in Social Security Treasury bills. Q: What are my investment choices? More |

|||

|

12:33 pmSo What are You Trying to Say? Courtesy of Talking Points Memo, here's a quote from somebody Hastert and DeLay probably aren't going to get to. No matter how much threatening and arm twisting: ...Not only is Social Security nowhere near exhaustion, the projections of bankruptcy do not reflect the many ways we can strengthen the system for the future without aggressive or risky reforms..." You'd think that came from the desk of Ted Kennedy. Nope. It's none other than Congresswoman JoAnn Emerson (R-Missouri) |

|||

| Thursday, February 3 | |||

|

3:46 pmRepublican Math, Vol. 1 I found this from the Washington Post quite interesting (courtesy of Washington Monthly): "You'll be able to pass along the money that accumulates in your personal account, if you wish, to your children . . . or grandchildren," Bush said last night. "And best of all, the money in the account is yours, and the government can never take it away." The plan is more complicated. Under the proposal, workers could invest as much as 4 percent of their wages subject to Social Security taxation in a limited assortment of stock, bond and mixed-investment funds. But the government would keep and administer that money. Upon retirement, workers would then be given any money that exceeded inflation-adjusted gains over 3 percent. That money would augment a guaranteed Social Security benefit that would be reduced by a still-undetermined amount from the currently promised benefit." So I can invest my money in private accounts, not get any extra earnings if the professional money managers and the economy can't earn over 3%, AND have my benefit cut? Wow, this reform stuff is getting better by the minute.... But wait, there's more.... "With a 4.6 percent average gain over inflation, the government keeps more than 70 percent. With the CBO's 3.3 percent rate, the worker is left with nothing but the guaranteed benefit. If instead, workers decide to stay in the traditional system, they would receive the benefit that Social Security could pay out of payroll taxes still flowing into the system, the official said. Which option would be best is still unclear because the White House has yet to propose how severely guaranteed benefits would be cut for those with individual accounts. The administration official explained that the "benefit offset" merely ensures that those who choose personal accounts are not given an unfair advantage over the traditional system." Bush's goal is to "personalize" Social Security. Wouldn't it make more sense to allow people to enjoy the excess gain; making it more attractive? With detail of the benefit cut still MIA (and we probably won't get these until after the bill passes or fails), they are creating arguments against their own program. Unless they already know benefit cuts will be so deep that the privatized option seems a better deal. And finally, the comparison to Clinton's "Save Social Security First" program. "But critics of the Bush plan said the proposed "claw back" renders the whole idea of "personal retirement accounts" virtually meaningless. Indeed, the system would ultimately look something like a proposal made by President Bill Clinton, in which the government would have invested Social Security taxes in the stock market. That idea was criticized by conservatives because the federal government could end up choosing winners and losers in the financial markets. But under the Bush system, the government is still choosing the stocks and bonds to be bought with Social Security money, said Jason Furman, a former Clinton administration economist. Individuals would get a limited choice, and the government would still keep most of the returns." I still wonder that if the stock market is good enough for individuals to invest their Socal Security money in, why can't Bush sell some T-Bonds and invest it in the markets? Why isn't that good enough? I like what Kevin Drum says about this story: The worst part of the whole thing is how unnecessary it is. As you know, I think the projections of insolvency in 2042 are overly pessimistic, but even if you accept those projections a bipartisan solution could be crafted in about half an hour. Back in 1998 most Democrats (as well as AARP) were ready to support a plan that cut benefits modestly by modifying the formula used to calculate cost-of-living increases. Republican Lindsey Graham has been gathering support for the idea of increasing the cap on the amount of income subject to the payroll tax (from $90,000 to about $200,000). Both Dems and Republicans are open to the idea of investing some or all of the trust fund in equities instead of treasury bonds. Those are simple, moderate, common sense solutions that would cost very little and would cause minimal pain; they could easily gain broad bipartisan support and would solve Social Security's problems into the next century and beyond. There's exactly zero reason to make an enormous partisan battle out of this. |

|||

|

2:10 pmFor $3.84 Every Two Weeks, YOU Can Save Social Security I read where a 2% increase in the payroll tax could solve the problems of Social Security. For me, that's $3.84 extra out each of my 26 pay periods for 2005. How much is yours? Are you so poor you'll miss $3.84 every two weeks? |

|||

|

AN ANALYSIS OF SENATOR GRAHAMS SOCIAL SECURITY PLAN Thursday, February 3 (Center for Budget and Policy Priorities)Senator Lindsey Graham (R-SC) introduced a Social Security plan in the 108th Congress, reportedly developed with the help of White House staff, that is based on the main plan designed by President Bushs Social Security Commission. This analysis examines that plan. It also considers the effects of Senator Grahams subsequent proposal to raise the ceiling on the amount of wages subject to the Social Security payroll tax, which is not part of the plan that Graham introduced. More Ed Note: The main elements of this plan are rumored to be applied in the Bush plan. |

|||

| Wednesday, January 26 | |||

|

Critics overstate Social Security ills Sen. Wayne Allard told a town meeting in Greeley that the Social Security system could face a $28 trillion debt. Congressional reports don't concur. Wednesday, January 26 (Denver Post)Advocates of radical reform are making up their own math in their campaign to partly privatize Social Security. There's a storm ahead, but not the iceberg President Bush's advisers claim. Even Rep. Bill Thomas, Republican chair of the House Ways and Means Committee, called Bush's plan "a dead horse" and said Congress should take a broader look at the issues facing an aging nation. Given these facts, voters should question comments made recently by Wayne Allard, Colorado's senior U.S. senator. Allard hasn't formally endorsed Bush's plan, but at a Jan. 12 town meeting in Greeley, he was asked about the issue. Allard said that in 2018, Social Security is projected to start paying out more in benefits than it will collect in payroll taxes. According to the Greeley Tribune, Allard said that "there are no reserves in Social Security because what is there is automatically transferred into the general fund, leaving a debt of $28 trillion." He went on to say, "The money is spent. I don't believe we'll be able to raise the funds to pay it back." More |

|||

|

Bush makes Social Security pitch Meeting with black supporters intended to boost public acceptance for overhaul plans Wednesday, January 26 (Houston Chronicle)Race became a significant factor in the debate over Social Security on Tuesday when President Bush told black leaders that the government retirement program shortchanged blacks, whose relatively shorter lifespan means they pay more in payroll taxes than they eventually receive in benefits. Bush's comments came during a private White House meeting with 22 black religious and business leaders who backed his re-election last year marking a new line of argument in the president's attempts to win support for adding worker-owned investment accounts to Social Security. More |

|||

|

Editorial: Social Security/Blacks get more, not less, from it Wednesday, January 26 (Star Tribune)Of all the lies -- let's call them by their right name -- that the Bush administration is spreading about Social Security, none is as vile as the canard Bush repeated last Tuesday, when he said, "African-American males die sooner than other males do, which means the [Social Security] system is inherently unfair to a certain group of people. And that needs to be fixed." That is an entirely phony assertion; it has been debunked by the Social Security Administration, by the Government Accountability Office and by other experts. Bush and those around him know that. For them to repeat what they know to be a blatant lie is despicable fear-mongering. More |

|||

| Thursday, January 20 | |||

|

Use Tax Refunds to Help Americans Save Thursday, January 20 (New America Foundation)President Bush has put tax and social security reform high on the agenda for his second term. He's highlighted the need to increase retirement savings and called the tax code a complicated mess that hinders the economy. Another fundamental drag on long-term growth is our low personal savings rate, and the tax code doesn't help here either. But there's a simple reform to the tax system that can help millions of Americans increase their savings without changing any laws or spending a dime. Every year, the IRS sends out refund checks averaging $2,100 to more than 120 million taxpayers. These tax windfalls often provide families their best opportunity to save. Right now, taxpayers have one choice: the entire refund comes back in a lump sum. If we make it easier for people to save right on their tax forms, to split their refunds into "money to save" and "money to spend," people will save more - perhaps much more. More Ed note: these could easily be adapted to use for retirement as well as savings |

|||

|

A Social Security 'Disaster' Predicted * Democrats intensify their assault on Bush's personal account plan, citing GOP resistance. Thursday, January 20 (Los Angeles Times)Top Democrats in Congress toughened their attack Wednesday on President Bush's call for personal investment accounts under Social Security and said remarks by a powerful Republican committee chairman showed GOP lawmakers had little appetite for the accounts. Bush's plan would mean benefit cuts, higher debt and a "disaster for the most successful social program in the history of the world," said Senate Democratic leader Harry Reid of Nevada. Referring to comments made Tuesday by Rep. Bill Thomas (R-Bakersfield), Rep. Nancy Pelosi of San Francisco, the House Democratic leader, said they were "a nonstarter even in his own party." Thomas, chairman of the House Ways and Means Committee, said Tuesday that Congress should debate Social Security more broadly than Bush has suggested. He said lawmakers also should consider the possibility of giving men and women different benefits, allowing blue-collar laborers to retire earlier than white-collar workers and helping older people defray the cost of long-term care. He also said the payroll tax that funds Social Security was a barrier to job creation. More |

|||

|

WOULD BORROWING $2 TRILLION FOR INDIVIDUAL ACCOUNTS ELIMINATE $10 TRILLION IN SOCIAL SECURITY LIABILITIES? Thursday, January 20 (Center for Budget and Policy Priorities)Administration officials have been downplaying the significance of the $2 trillion in transition costs required by some individual accounts plans, by comparing that cost to the unfunded liability in Social Security over an infinite time horizon, which totals more than $10 trillion. For example, White House Press Secretary Scott McClellan responded recently to a question about how the White House would pay for the $2 trillion transition cost by arguing Its a savings, because the cost is $10 trillion of doing nothing, and this will actually be a savings from that cost of doing nothing.[2] This argument is misleading. The $10 trillion number is taken out of context; it refers to the Social Security shortfall not over 75 years, but into eternity. Social Security does face a long-term deficit, but it is relatively modest as a share of the economy; in fact, it is considerably smaller than the cost of the tax cuts passed in 2001 and 2003, if those tax cuts are made permanent. More fundamentally, borrowing $2 trillion to fund individual accounts does nothing to reduce Social Securitys long-term deficit. Individual account plans that eliminate the long-term deficit in Social Security, such as the principal plan the Presidents Social Security commission proposed, do so entirely by reducing future Social Security benefits, not because of borrowing. More |

|||

|

DOES SOCIAL SECURITY FACE A CRISIS IN 2018? Thursday, January 20 (Center for Budget and Policy Priorities)A recently leaked White House memo indicates that the first phase of the Administrations strategy to sell individual accounts will be to convince Americans that the Social Security system is heading for an iceberg.[1] The President frequently cites 2018 as the beginning of a Social Security crisis that, he says, will leave the system bankrupt.[2] Others claim that Social Security will hit a crisis in 2018 when, to pay benefits, the system will become dependent upon what they describe as worthless IOUs. These statements seriously misrepresent Social Securitys financing and the challenges the program faces. Furthermore, even if one were to grant the Presidents arguments, they would make the individual-accounts plan he is considering less attractive. Under the principal plan the Presidents Social Security Commission designed, the milestone that the President cites as a major turning point for Social Security the point at which Social Security benefit costs will start to exceed Social Security tax revenue would be reached twelve years sooner, in 2006 rather than 2018. More |

|||

| Tuesday, January 11 | |||

|

The Iceberg Cometh By PAUL KRUGMAN Tuesday, January 11 (New York Times)Last week someone leaked a memo written by Peter Wehner, an aide to Karl Rove, about how to sell Social Security privatization. The public, says Mr. Wehner, must be convinced that "the current system is heading for an iceberg." It's the standard Bush administration tactic: invent a fake crisis to bully people into doing what you want. "For the first time in six decades," the memo says, "the Social Security battle is one we can win." One thing I haven't seen pointed out, however, is the extent to which the White House expects the public and the media to believe two contradictory things. More |

|||

|

Social Security debate starts in earnest today Bush to stress need for private accounts Tuesday, January 11 (SFGate)President Bush will officially open today the Republican version of a domestic policy brawl that will rival in scope, intensity and political difficulty the 1993-94 effort by then-President Bill Clinton to remake the nation's health care system. Bush's plan to add private accounts to Social Security, as a leaked White House memo to congressional Republicans put it last week, "will be one of the most important conservative undertakings of modern times. ... The scope and scale of this endeavor are hard to overestimate." On the flip side, the enterprise faces all the land mines of Clinton's failed effort: The idea of individual accounts, like universal health care, may sound popular, but the devil is in the details. The financial and technical challenges are enormous. Well-heeled lobbying groups such as AARP promise to apply every bit of their firepower to defeat the plan. AARP already has spent $5 million to frame the debate before Bush does, buying ads showing a Social Security card turned on its side like a playing card with the tag phrase, "If we feel like gambling, we'll play the slots." Democrats -- even moderates such as California Sen. Dianne Feinstein, who voted for Bush's tax cuts and Medicare reforms -- are almost universally opposed. For liberal Democrats, private accounts are heresy, much as Clinton's health care plan was for Republicans. And, as it was for Clinton and Democrats in 1994, the political risk for Bush of changing Social Security is sending tremors through splintered Republican ranks. As one observer put it, who needs Democrats when you've got conservative luminaries Newt Gingrich and Jack Kemp warning that Bush's plan is going to destroy the GOP? More |

|||

| Thursday, January 6 | |||

|

5:12 pmThey Came Again, In the Same Old Way--Let's Whoop Some A*#! The first time this happened, I thought it was a ploy or a trap. Then, as it played out over time, I found it to be real. I'm talking about the computer disk that was left in a DC park by a Republican staffer. This happened back in 2002. On it contained the plans on how the Bushies were going to roll out the Iraq war. Democrats thought it unimportant, something not worth the time of day. In hindsight, I compare it to having the plan to bomb Pearl Harbor 6 months beforehand. We, as Democrats did nothing about it. But for us, we pretty much lost our aircraft carriers as well as our battleships. Now we have a contemporary. It's the Wehner Memo, courtesy of Josh Marshall. It's a plan on how they will sell the Gutting of Social Security. "Leaked" to us by an assistant to Karl Rove. Check it out. Is it a ploy? Not anymore, as we already know how they work. I'm thinking the memo is a "nyah-nyah-nyah," as if to taunt us. Let's use the taunt to kick their heinies. |

|||

| Wednesday, January 5 | |||

|

3:42 pm3 Points to Save Social Security As they hit me, I'll pass them along to you. These 3 don't need much explanation: 1) Understand that Social Security is an insurance program, not a retirement plan. It is a part, a PART, of a comprehensive package of retirement income consisting of savings, investments, and pensions. 2) Increase the payroll tax in order to fix the shortfall. We should have done this in the 80's, but it's not much of an increase. 2% of my payroll tax income amounts to an extra $35 per week. Am I so greedy I can't spare $35/week for my retirement, and to help the retirement of others? No. 3) Remove all contribution limits on IRA plans, and make those contributions tax deductible. Duh. Make payroll deduction the primary way to make these contributions as well. Double duh. |

|||

| Tuesday, January 4 | |||

|

5:45 pmPlayin' Possum? I read the WaPo story in the previous post. And again, I am befuddled by the Bushies. Is their proposal to cut Social Security benefits by one-third the opening bid in his negotiation with Congress? Will they in turn cut more, or will they respond to the outcry of their constituents (I hope) and throttle back Bush's cuts? What about benefits to disabled workers? Death benefits paid to wives and children of workers? There's so much more to Social Security other than the retirement payout. And without a concerted effort from Democrats, the Bush media juggernaut on what's wrong with Social Security could drown out any and all reality-based proposals for its responsible reform. Even now, the debate is essentially Bush's plan versus doing nothing. No voices of reason are rushing in with information to refute Bush, or show us a more responsible plan than borrowing $2 trillion dollars to distribute to Wall Street. This will be the fight of a generation. It could be seen as our willingess, as a people and a nation, to confirm or reject the concept of generational responsibility. What a nation does when it rejects a moral of this importance, I don't know. And I don't want to find out. Write your representative. Social Security must survive. |

|||

|

Social Security Formula Weighed Bush Plan Likely to Cut Initial Benefits Tuesday, January 4 (Washington Post)The Bush administration has signaled that it will propose changing the formula that sets initial Social Security benefit levels, cutting promised benefits by nearly a third in the coming decades, according to several Republicans close to the White House. Under the proposal, the first-year benefits for retirees would be calculated using inflation rates rather than the rise in wages over a worker's lifetime. Because wages tend to rise considerably faster than inflation, the new formula would stunt the growth of benefits, slowly at first but more quickly by the middle of the century. The White House hopes that some, if not all, of those benefit cuts would be made up by gains in newly created personal investment accounts that would harness returns on stocks and bonds. More |

|||

| Monday, December 27 | |||

|

The Selling Of Social Security Reform Monday, December 27 (BusinessWeek)It sounds like a challenge for Madison Avenue's sharpest wizards: Create a public groundswell for an untested financial product that could entail potentially large risks for customers. Now add this caveat: A botched sales job will backfire and send your stock reeling. That's the dilemma facing George W. Bush as he launches a marketing blitz to win support for private Social Security accounts. Advisers say the President, who sees private accounts as essential to his Ownership Society agenda, is determined to make retirement reform his top domestic priority for 2005. But after supporting the concept for five years, Bush has yet to embrace a specific plan or reveal how he will pay for the $1 trillion to $2 trillion cost of implementing a quasi-private system. More |

|||

|

Tepid approval ratings won't help Bush enact sweeping agenda Monday, December 27 (Knight Ridder) While President Bush's big ticket agenda is backed by what he calls "political capital," events are already shrinking his account. American deaths in Iraq, mounting criticism of Defense Secretary Donald Rumsfeld, and complaints by some congressional Republicans have produced so-so approval ratings for Bush, less than a month before he is sworn in for a second term. Ratings around 50 percent, lower than previous re-elected presidents, won't help the president as he seeks to revamp Social Security, redo the tax code, or restrict lawsuit damage awards. "He may have a big agenda, but the public's agenda is Iraq," CNN analyst William Schneider said. More |

|||

|

Wall St could make a social security killing Monday, December 27 (The Australian)IT'S not often even the best-connected and most powerful industry encounters a group of equally powerful politicians desperate to put $US1 trillion ($1.3 trillion) in its collective pocket. So it is unsurprising Wall Street has so far been silent on the Bush administration's post-election push for social security reform, including redirection of a share of new contributions to private retirement accounts. Although most financial leaders support the idea and industry groups (plus armies of lobbyists) are working behind the scenes in Washington to make a case for private accounts, no CEO of a major financial firm is likely to go public soon. That's because Wall Street has learnt from the past two times the idea of legislating trillions of dollars into its hands came up, in the late 1990s and again in 2001. More |

|||

|

One man's retirement math: Social Security wins Monday, December 27 (Christian Science Monitor)At the heart of President Bush's plan to sell Social Security private accounts is a simple notion: You're always better off investing your retirement money than letting the government do it. By doing it yourself, you can stow some money in the stock market, and over the long run will get a better return on that investment than today's Social Security system offers. The idea is broadly accepted. That's why the administration's plan to partially privatize the system sounds appealing to many. But that better return won't always happen. Just ask Stanley Logue of San Diego. For 45 years, the defense-industry analyst paid into the system until his retirement in 1994. But with all the recent hoopla over reform, Mr. Logue, a Massachusetts Institute of Technology graduate, decided to go back and check his own records. Would he have done better investing his money than the bureaucrats at the Social Security Administration? More |

|||

|

3:31 pmJohn Snow as Kingmaker? Remember the heady days of Peter Lynch and Fidelity's Magellan fund? Fortunes were made and lost on his stock picks. Books were written on how he chooses companies to invest in and how to follow their successful management formulas. Lynch was a kingmaker. Now, imagine, in a market under a privatized Social Security, The chairman of the United States Treasury Department is the biggest investor ever, managing $1.5 trillion dollars. Imagine the influence over individual stocks and markets $1.5 trillion can have. Say the government moves into international funds. Imagine the ripple effect that could be felt marketwide. It could punish some currencies, and save others. Same for a move into small-cap stocks or a move into any sector. Fortunes could be made on the companies and funds this money moves into; not to mention the windfall in managment fees. Could this be part of a thriving market? Perhaps. A very big red flag for corporate greed? Knowing human nature, oh yes. A risk that should be associated with Social Security? I say no, but you decide for yourself. |

|||

| Thursday, December 23 | |||

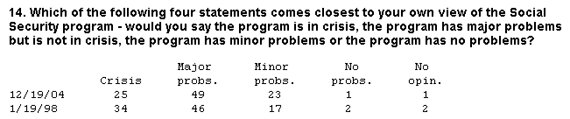

12:31 pmThis is Why Republicans Must Lie in order to Trash Social Security The above if from the ABC/WaPost poll on Social Security reform. In "Collective Interests," I posted a Reuters article indicating the admistration will kick off an election-style campaign in January to "edum-a-cate" the public on the need for social security reform. So, like tax cuts and Iraq, the president will create a crisis. Why do we let him get away with it. We've been fooled twice, why allow it a third time? If Republicans don't create a crisis, then we won't see the need for their version of reform. Real simple. Republicans need, no, are genetically driven to replace a system that invites some dependence on government with one that depends on the free market. To them it will be their defining moment to date. Do we need to fix Social Security? Yes. A lot? No. Can conservatives do it? Not the ones we currently have in power. |

|||

|

12:20 pmNot a Bad Idea.... From Phillip Longman, appearing at the New Century Foundation website: "The idea starts with the creation of Early Retirement Accounts. Individuals could put one-sixth of the money they and their employers currently pay to Social Security into 401(k)-like accounts, which they could use to finance retirement beginning at age 62. How would Social Security make up for the loss of revenue? Monthly Social Security benefits would remain what they are today, but the age at which future retirees qualified for them would be delayed. Today you can qualify for early, reduced benefits at age 62; that age would gradually increase to 68. The retirement age for full benefits would be pushed back from 65 to 72. Preliminary analysis by the SSA indicates that the rollback in retirement ages would not only save enough money to fund the Early Retirement Accounts, but also return the system to solvency." I'd like to hear more on disability and early death benefits, but this isn't bad. BTW, has anyone heard anything from the Democrats on this yet? There's lots of hubub in the blogosphere, but nothing out of DC. Please, please, God don't let our pinhead Democrat leaders get more pinheaded by letting this opportunity to save and redefine our party go by.... |

|||

|

Wednsday, December 22, 3:14 pmSo Far, the Greatest Thing I've Seen On Social Security The Social Security Simulator. From the website: Our simulation tool allows you to test all the key strategic options - cutting benefits, raising the payroll tax, allowing the Trust Fund to invest in stocks and corporate bonds, creating Personal Retirement Accounts (PRA's), a new injection of capital, ongoing federal subsidies, borrowing - and see their impact. I'm going to give it a few tries over the next few days. I'm somewhat leery of the simulation's parameters, but if anything it should help you see the interrelationships. If privatization ALWAYS comes out better, I'll definately be suspect. |

|||

|

Buying Into Failure By PAUL KRUGMAN Friday, December 17 (New York Times)...As the Bush administration tries to persuade America to convert Social Security into a giant 401(k), we can learn a lot from other countries that have already gone down that road...Decades of conservative marketing have convinced Americans that government programs always create bloated bureaucracies, while the private sector is always lean and efficient. But when it comes to retirement security, the opposite is true. More than 99 percent of Social Security's revenues go toward benefits, and less than 1 percent for overhead. In Chile's system, management fees are around 20 times as high. And that's a typical number for privatized systems.... ...These fees cut sharply into the returns individuals can expect on their accounts. In Britain, which has had a privatized system since the days of Margaret Thatcher, alarm over the large fees charged by some investment companies eventually led government regulators to impose a "charge cap." Even so, fees continue to take a large bite out of British retirement savings.... |

|||

|

INFLATION AND SOCIAL SECURITY Thursday, December 16 (Political Animal)....One of the things that's slowly becoming clear in the Social Security debate is that President Bush's advisors are probably not going to risk what's left of their professional reputations by pretending that private accounts can fix Social Security's future funding shortfall. Instead, they're going to propose benefit cuts in order to balance the books. As my readers know, I'm not in favor of making any changes to Social Security at the moment. The "funding shortfall" has a strong Chicken Little flavor to it, and even if it turns out to be real there's little reason to try fixing it four decades ahead of time. Still, the subject is on the table, and it's worth unpacking the specific benefit cut that appears to be everyone's favorite right now: indexing future benefit increases to prices instead of wages. When I first got interested in Social Security many years ago, this initially struck me as a reasonable idea, but it's the kind of thing that looks worse and worse the closer you look at it. So, since we're all going to be hearing a lot more about this over the next few months, it's worth understanding what it means. More |

|||